The "

Flash Crash" really was scary for anyone who traded through it and in a way reminded all market participants of the fury which can occasionally be unleashed so swiftly and severely.

Click to enlarge

The above is a 1 minute chart of the emini S&P 500 during the day of the flash crash. As can be seen, a lot of volume chased the market down resulting in a crescendo where the low point also experienced the highest volume before turning around and retracing most of the move rather quickly.

Click to enlarge

The emini Nasdaq also shows an identical move of a high volume peak as the market found bottom before screaming up.

Click to enlarge

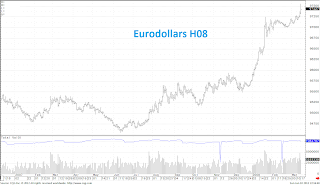

Front month eurodollars had a similar move which tracked equities as often is the case during market panics and the contract had a 15bps fall in a matter of minutes. Something was definitely weird about the day and I can remember getting as hedged as possible right before the spike down which really saved me that day. From what I recall, the order book was ultra thin and selling an offer was impossible before the freefall and that's as sure as sign on what direction the market is going.

Click to enlarge

On the flipside, the eurodollar contract a year further had a flight to safety spike which virtually mirrored the front month's move.

Click to enlarge

Which resulted in the M10/M11 eurodollar spread to move from 75 before the move to as low as 42.5 with the vast majority of that happening in a few minutes. Another chart which hurts to look at just thinking about how painful it'd be to sit unhedged on.

Click to enlarge

Or course there is no greater flight to safety than long term US treasuries and above is the 30yr.

Click to enlarge

Crude surprisingly wasn't as correlated to panic as other markets but nonetheless had a severe move in it's own right.

Click to enlarge

And for the hell of it here's the euro currency chart which like crude panicked lower but not like equities.

Click to enlarge

Same goes for gold, a move but easily stayed within the earlier day's range.